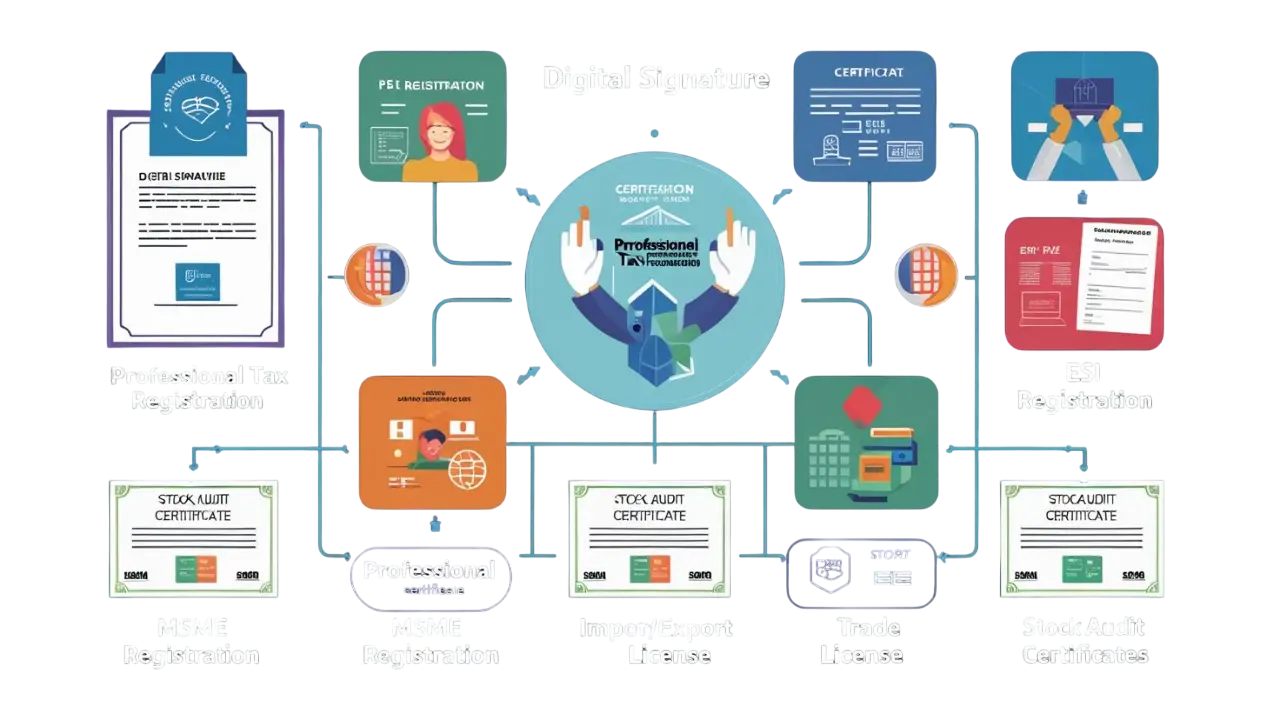

Business Essentials: Licenses & Registrations Made Easy

Business Compliance Doesn’t Have to Be Complicated—We Make It Simple.

At GSTBookkeeper, we handle everything from your Digital Signature Certificate to Professional Tax, ESI, PF, MSME Registration, Trade License, Import/Export Code, and even Stock Audits. Whether you’re launching a new venture or managing ongoing compliance, we’re your trusted partner. Focus on growing your business—we’ll take care of the paperwork, deadlines, and registrations.

From Licenses to Audits—All-in-One Business Compliance Care

Digital Signature Certificate

🔐 Digital Signature Certificate (DSC) – Detailed Overview

A Digital Signature Certificate is the digital equivalent of a physical signature. It’s used to sign documents electronically and is legally valid under the Information Technology Act, 2000. It ensures the authenticity, integrity, and security of online documents, filings, and transactions—essential for businesses and professionals operating in digital environments.

✅ Why You Need a DSC:

Required for filing ROC forms with the Ministry of Corporate Affairs (MCA)

Mandatory for GST filing, Income Tax e-filing, and EPFO/ESIC compliance

Used for tender submissions, e-bidding, and customs clearance

Ensures document security and identity validation during digital communication

🧑💼 Who Needs It:

Directors and designated partners of companies/LLPs

Authorized signatories for GST, ITR, or MCA filings

Individuals or professionals applying for government tenders

CA/CS/consultants managing client compliance online

📋 Types of DSC:

| Type | Purpose |

|---|---|

| Class 3 DSC | Used for company filings, GST, tenders, and high-security transactions |

| DGFT DSC | Specifically for Importers & Exporters to use on DGFT portal |

📑 Documents Required:

PAN card and Aadhaar card of applicant

Passport-size photograph

Address proof (Utility bill/Bank Statement)

Business proof (for organizations)

⏱️ Validity:

Issued for 1 or 2 years

Renewable before expiry

⚙️ How We Help:

Paperless DSC processing and Aadhaar-based eKYC

Quick issuance within 1–2 working days

USB e-Token delivery (if needed)

Assistance in installation and usage

Professional Tax Registration

🧾 Professional Tax Registration – Detailed Overview

Professional Tax is a state-level tax levied on income earned by professionals, traders, and salaried employees. It is imposed by the state government and varies across different states in India. Employers are responsible for deducting and paying professional tax on behalf of their employees, while self-employed individuals pay it directly.

✅ Why It’s Important:

Mandatory in most Indian states for both employers and professionals

Required for business registration in many municipal jurisdictions

Avoids penalties or interest for non-compliance

Builds credibility with government departments

🏛️ Who Needs to Register:

Businesses with salaried employees (must register as an employer)

Self-employed professionals such as CA, CS, doctors, lawyers, consultants

Freelancers and traders (in states where applicable)

📋 Employer vs. Individual Registration:

| Type | Applicability |

|---|---|

| Professional Tax – Employer Registration | Required if you employ staff and deduct PT from salaries |

| Professional Tax – Individual Registration | Required for self-employed individuals and professionals |

📑 Documents Required:

PAN and Aadhaar of employer/individual

Business address proof (utility bill/rent agreement)

Identity and address proof of signatory

Salary details (for employee registration)

Incorporation certificate (if applicable)

Board resolution or authorization letter

⏱️ Timeline:

Registration usually takes 3–7 working days, depending on the state

📌 Post-Registration Compliance:

Monthly or Quarterly PT payment (as per slab and state)

Professional Tax Return filing

Maintain records of employee salaries and deductions

🗺️ Applicable States:

Professional tax is applicable in most Indian states including Maharashtra, Karnataka, Tamil Nadu, West Bengal, Gujarat, and Telangana. Each has its own slab rate and rules.

ESI Registration

🏥 ESI Registration – Detailed Overview

ESI (Employees’ State Insurance) is a self-financed social security scheme regulated by the Employees’ State Insurance Corporation (ESIC) under the ESI Act, 1948. It provides medical, sickness, maternity, and disability benefits to employees earning up to a certain wage threshold and their dependents.

✅ Why ESI Registration Is Important:

Ensures medical and financial protection for employees and families

Mandatory for employers with 10 or more employees (in most states)

Helps fulfill legal compliance under Indian labour laws

Employees and employers both contribute a small portion of wages

🧑💼 Who Needs ESI Registration:

Companies, factories, shops, or establishments with 10+ employees

Employees earning ₹21,000/month or less (₹25,000 for persons with disabilities)

Organizations covered under state-specific thresholds (varies slightly)

📋 Contribution Structure (as of latest rules):

| Contributor | Rate of Contribution |

|---|---|

| Employer | 3.25% of employee wages |

| Employee | 0.75% of wages |

Note: Employees earning less than ₹176 per day are exempted from contribution.

📑 Documents Required for ESI Registration:

PAN & address proof of the business

Registration certificate (GST, Factory Act, Shops & Establishments)

List of all employees with their salary details

Employee Aadhaar and bank details

Digital Signature of the employer

Monthly employee attendance record

⏱️ Registration Timeline:

Can usually be completed within 5–10 working days

📌 Post-Registration Compliance:

Regular ESI contributions through the ESIC portal

Filing ESI Returns semi-annually

Maintenance of employee and salary records

Intimating any changes in employee count or salary structure

🩺 ESI Benefits for Employees:

Free medical care for employees and dependents

Sickness, maternity, and disability leave benefits

Funeral expenses, unemployment allowance, and more

Access to ESIC hospitals and dispensaries nationwide

PF Registration

🏦 PF Registration – Detailed Overview

Provident Fund (PF), governed by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, is a retirement benefits scheme managed by the Employees’ Provident Fund Organization (EPFO). It helps employees build long-term savings for retirement while also providing financial stability in case of emergencies.

✅ Why PF Registration Matters:

Mandatory for employers with 20 or more employees

Promotes employee retention and financial security

Enhances the organization’s compliance and credibility

Employers and employees both make monthly contributions

🧑💼 Who Needs to Register:

Companies, factories, and organizations with 20+ employees

Voluntary registration allowed for firms with fewer employees

All salaried employees drawing up to ₹15,000/month must be enrolled (can cover above ₹15,000 with mutual consent)

📋 PF Contribution Breakdown:

| Contributor | Rate | Contribution |

|---|---|---|

| Employer | 12% | 3.67% EPF + 8.33% EPS (pension scheme) |

| Employee | 12% | Entirely to EPF |

Some organizations may contribute at a reduced rate of 10% based on eligibility.

📑 Documents Required:

PAN of the company

Certificate of incorporation (Company/LLP/Partnership)

Address proof of business (utility bill/rent agreement)

Specimen signature of authorized signatory

Employee salary and ID details

DSC (Digital Signature Certificate) of authorized person

⏱️ Registration Timeline:

Usually completed within 5–7 working days

Online registration via EPFO portal

📌 Post-Registration Compliance:

Monthly PF payments through EPFO portal

Filing of Electronic Challan-cum-Return (ECR)

Updating employee details and UAN (Universal Account Number)

Maintaining records of contributions and employee data

🎯 Benefits of PF to Employees:

Long-term retirement savings

Partial withdrawal for medical, housing, or education needs

Monthly pension through EPS

Insurance benefit under EDLI (Employees’ Deposit Linked Insurance)

MSME Registration

🏢 MSME Registration – Detailed Overview

MSME Registration is a government initiative under the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006, to support and promote businesses falling under the MSME category. It offers recognition, legal status, and access to various schemes and benefits from the Government of India.

Since 2020, MSME registration is done through the Udyam Registration portal using a completely paperless, Aadhaar-based process.

🧩 MSME Classification (as per investment & turnover):

| Enterprise Type | Investment in Plant & Machinery | Annual Turnover |

|---|---|---|

| Micro | Up to ₹1 crore | Up to ₹5 crore |

| Small | Up to ₹10 crore | Up to ₹50 crore |

| Medium | Up to ₹50 crore | Up to ₹250 crore |

✅ Why Register as MSME:

Easier access to collateral-free loans

Interest rate subsidies on bank loans

Priority in government tenders

Protection against delayed payments

Easier access to industrial subsidies, tax rebates & schemes

📋 Eligibility:

Sole Proprietorships, Partnerships, Private Limited Companies, LLPs

Service & manufacturing sector businesses

Business must fall within investment & turnover limits mentioned above

📑 Documents Required:

Aadhaar number of owner/partner/director

PAN card of the business (or individual for proprietorship)

Business address proof

Bank account details

NIC (National Industry Classification) code

No additional documents required under Udyam (self-declaration-based)

⏱️ Timeframe:

Entire process is online & instant

Udyam Certificate is issued immediately upon registration

📌 Post-Registration Benefits:

Avail Udyam Registration Number (URN) & Certificate

Apply for government subsidies, grants, and schemes

Easy bank loan approvals under priority sector lending

Faster approvals for licenses and registrations

Trade License

🧾 Trade License – Detailed Overview

A Trade License is a legal document issued by the local municipal authority that allows an individual or company to carry on a specific trade or business at a specific location. It ensures that the business complies with the safety and regulatory standards laid out by local civic bodies.

🏢 Why Trade License Is Required:

Ensures the business activities are legally approved

Regulates businesses in line with health and safety laws

Prevents unethical business practices in residential or restricted areas

Mandatory for businesses like restaurants, shops, factories, warehouses, etc.

📋 Who Needs a Trade License:

Any person or company involved in commercial, manufacturing, or trading activities within municipal limits

Especially applicable to businesses like food outlets, retail shops, hotels, salons, industrial units, and warehouses

🗂️ Types of Trade Licenses:

| License Type | Purpose |

|---|---|

| General Trade License | For shops, stores, warehouses, offices |

| Industrial License | For small and medium manufacturing units |

| Food Establishment License | For restaurants, food stalls, canteens, etc. |

📑 Documents Required:

PAN card of applicant/firm

Aadhaar card of the applicant

Address proof of business (electricity bill/rent agreement)

Certificate of Incorporation (for companies/LLPs)

Layout plan of the business premises

NOC from property owner (if rented)

Other licenses (FSSAI for food businesses, etc.)

🕒 Timeframe & Validity:

Issuance typically takes 7–15 working days depending on the city

Usually valid for 1 year and must be renewed annually.

📌 Post-License Compliance:

Display the trade license prominently at the business location

Renew license before expiry to avoid fines

Comply with zoning, safety, and pollution control laws

Obtain other sector-specific licenses if applicable (FSSAI, GST, etc.)

📍 Issued By:

Local Municipal Corporation or Urban Local Bodies (ULBs)

Import & Export License

🌐 Import & Export License (IEC) – Detailed Overview

An Import Export License, officially known as the IEC (Importer Exporter Code), is a 10-digit business identification number issued by the Directorate General of Foreign Trade (DGFT). It is mandatory for any business involved in importing or exporting goods and services from India.

✅ Why IEC is Important:

Required for customs clearance when importing or exporting goods

Mandatory to receive foreign remittances

Needed for shipping, banking, and logistics processing

Essential for export incentives and government schemes

🧑💼 Who Needs an IEC:

Individuals or businesses involved in international trade

Exporters (including freelancers offering services abroad)

Importers bringing goods into India

Not required for personal imports (not for commercial use)

📋 Key Features of IEC:

One-time registration – valid for lifetime

No renewal required unless updated

Same code works for both import and export

Required even if zero turnover in a particular year

Issued by DGFT (Directorate General of Foreign Trade)

📑 Documents Required:

PAN card of the business or proprietor

Aadhaar card (for proprietorship) or company incorporation documents

Address proof of the business (utility bill, rent agreement, etc.)

Bank account details and a canceled cheque

Digital Signature Certificate (for online application)

🕒 Timeline:

Registration can be completed within 1–3 working days via the DGFT portal

Certificate is issued in digital format only

📌 Post-Registration Compliance:

No monthly or annual return filing specific to IEC

Must update details if there is any change in business info (PAN, address, etc.)

Regular customs and foreign trade documentation still required

Businesses must comply with GST, FSSAI, or other relevant licenses depending on trade nature

🌟 Benefits of Having an IEC:

Access to global markets

Enables participation in export promotion schemes

Simplifies customs and logistics handling

Makes your business appear credible and international-ready

Stock Audit

📊 Stock Audit – Detailed Overview

A Stock Audit (also known as Inventory Audit) is the physical verification of a company’s inventory, combined with accounting records. It ensures that the actual stock matches the reported stock in books and helps detect discrepancies, prevent pilferage, and improve inventory management.

Stock audits are commonly required by banks, lenders, and internal stakeholders to validate inventory claims and maintain financial accuracy.

✅ Purpose of a Stock Audit:

Verify actual stock against book stock

Identify obsolete, slow-moving, or damaged stock

Ensure proper valuation of inventory

Detect theft, wastage, or mismanagement

Comply with bank loan requirements or statutory norms

🏢 Who Needs a Stock Audit:

Businesses seeking working capital loans

Companies with large inventories (retail, manufacturing, warehousing)

Startups or growing businesses aiming for financial hygiene

Organizations with multiple storage locations or warehouses

📋 Types of Stock Audit:

| Type | Purpose |

|---|---|

| Internal Stock Audit | Regular internal check for operational efficiency |

| External Stock Audit | Done by independent auditor or CA for third-party use |

| Bank Stock Audit | Mandated by banks before approving loan facilities |

🧾 Documents & Information Required:

Stock register and inventory reports

Purchase and sales invoices

Opening and closing stock statements

Stock valuation method (FIFO, LIFO, Weighted Avg.)

Previous stock audit reports (if any)

Physical access to storage areas/warehouses

Inventory movement records

🔍 Process Involved:

Planning – Define scope, locations, product categories

Physical Verification – Manual/tech-assisted counting of stock

Reconciliation – Match physical count with book records

Valuation & Analysis – Check pricing method and consistency

Reporting – Audit findings, discrepancies, recommendations

🕒 Frequency & Duration:

Typically done annually or semi-annually

Can take 1–5 days depending on business size and stock volume

📌 Outcomes of a Stock Audit:

Accurate financial reporting

Optimized inventory management

Eligibility for bank credit

Compliance with accounting and tax regulations

Prevention of inventory leakages